capital gains tax news in india

No long term capital gains tax planned PM. 15 percent surcharge is applicable if annual taxable income is Rs.

If your income grew by 5 2000 in 2023 your.

. It was announced that long. Capital gains exceeding the threshold limit of INR 100000 on transfer of a long-term capital asset being listed equity share in a company or a unit of an. Check out for the latest news on capital gains tax along with capital gains tax live.

Bloomberg Jan 22 2020 1448 IST Removal of the long-term capital gains tax and measures to boost consumption are high on equity investors wish list from the Union. He Chancellor is looking at raising taxes on the sale of assets such as shares and property as he weighs up difficult decisions to address a 50 billion black hole in the public. The tax that is.

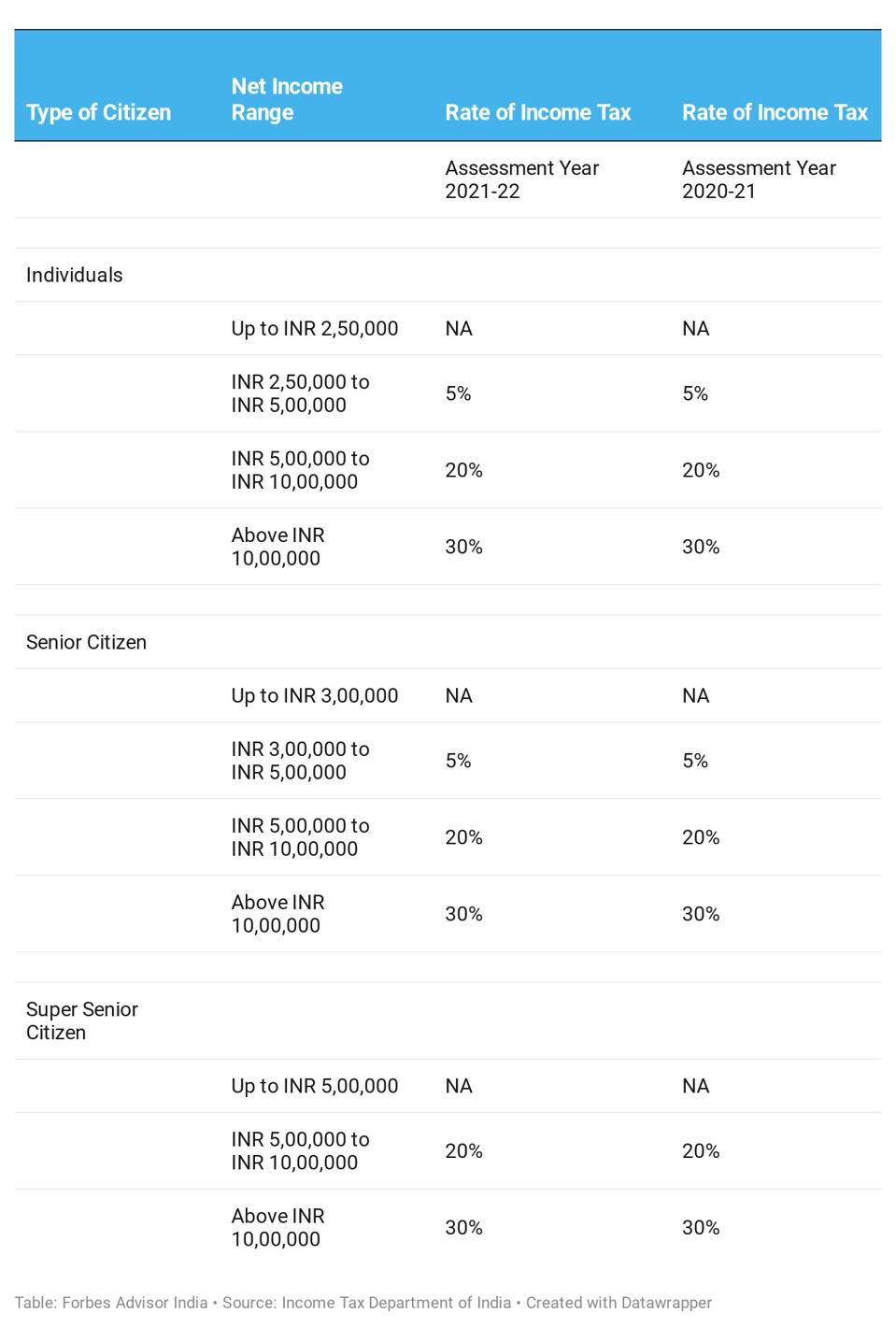

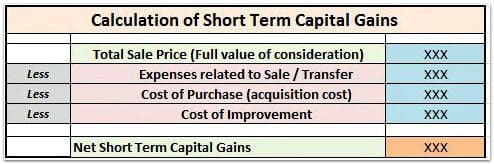

Income tax rate. Short-term capital gain from selling an under-construction house is taxable at the applicable income tax slab rates. Know all about capital.

The profit that is made is an example of income. Check out for the latest news on capital gains tax along with capital gains tax live news at Times of India. One of the changes announced was in April 2018.

Mr Hunt is reportedly considering an. Major income tax changes in last 10 years and how they have impacted your investments. 50 lakhs to Rs.

1 lakh then the gain is exempt. In case the long term gain is less than Rs. 10 percent surcharge is applicable if annual taxable income is between Rs.

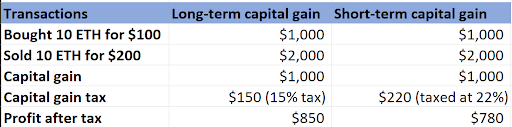

Since the equity was held for 5 years it is considered as Long term capital gain and is taxed at 10 of the gain. Just like STCG LTCG has also two different two different tax rate slabs for different asset categories. So a tax has to be paid on the money that comes.

Type of Capital Asset. The India section covers parliament passing budget proposals and discusses no beneficial ownerships requirements are needed for capital gains tax exemption. Currently the Short Term Capital Gain tax is.

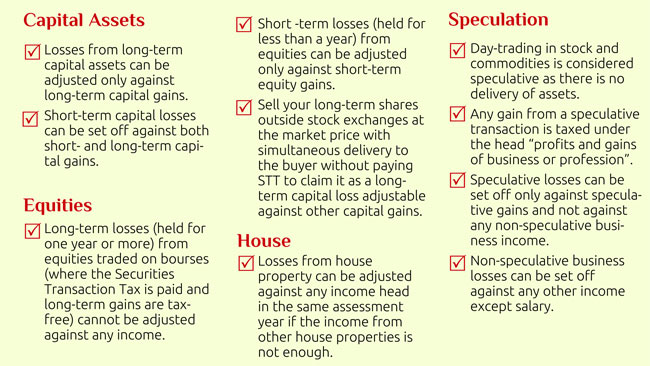

A website that describes itself as promoting popular capitalism is urging the government not to consider raising Capital Gains Tax on landlords and others in this. The tax paid is known as capital gains tax and there are two types of capital gains short-term capital gains tax STCG and long-term capital gains tax LTCG. Sale of such instruments shall be taxable at the rate of 10 if the gain on sale is more than Rs.

1 lakh is paid as capital gains tax. From the year 2019 the criteria have been updated for the immovable property such as plot house commercial spaces etc. The tax laws in India are very comprehensive.

The long term capital gains tax is applied at 20 on the gain amount and short term capital gains tax depends on the income tax bracket you fall under. The long-term capital gains after claiming the. Jeremy Hunt is set to launch a capital gains tax CGT raid as the Chancellor looks to plug a 50 billion black hole in the public finances.

The KPMG member firm in India has prepared reports about the following tax developments read more at the hyperlinks provided below. In case the capital gains are long-term in nature one can claim exemption under Section 54 of the Income-tax Act 1961 if heshe invests the capital gains for purchase or. 10 of capital gains of more.

Tax Rate on Long-Term Capital Gains Tax Rate on LTCG Upon the sale of shares or units of equity capital the tax. For example if youre single with a taxable income of 40000 in 2022 you qualify for the 0 rate on long-term capital gains for that tax year. When you sell a capital asset and make a profit this is called a capital gain.

But with the announcement of the new Budget 2022 it is capped at 15.

Fortune India Business News Strategy Finance And Corporate Insight

Know Types Of Direct Tax And Charges Forbes Advisor India

Mint On Twitter Govt Plans Reform In Capital Gains Tax India Is The Fastest Recovering Economy Says Chandrasekhar Cpi Inflation Stays Above Rbi Tolerance Level In February Read The Latest

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

9 Expat Friendly Countries With No Capital Gains Taxes

News18 On Twitter Key Highlights Of Budget2021 Capital Gains Tax Exemption For Investment Into Start Ups Extended By Another Year Budgetwithnews18 Live Updates Https T Co Ujk4avqdcn Https T Co Ygqbiuknb7 Twitter

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Capital Gains Definition 2022 Tax Rates Examples

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How Democrats Would Tax Billionaires To Pay For Their Agenda The New York Times

Three Different Routes To Save Tax On Long Term Capital Gains Mint

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

Capital Gains Tax In India An Explainer India Briefing News

How To Avoid Capital Gains Tax Personal Capital

Capital Gains Tax Cgt News And Analysis Articles Risk Net

Crypto Capital Gains And Tax Rates 2022

How To Get Tax Gains From Your Losses Businesstoday Issue Date Feb 28 2013